Car Insurance Usa Costs But, That Makes Insuring A Teen Driver Incredibly Expensive.

Car Insurance Usa Costs. This Coverage Protects The Occupants In The Other Vehicle If A Car Accident Occurs And You Are At Fault.

SELAMAT MEMBACA!

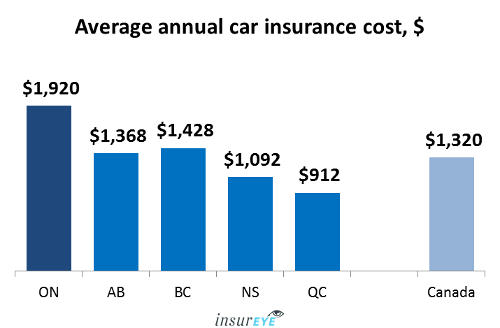

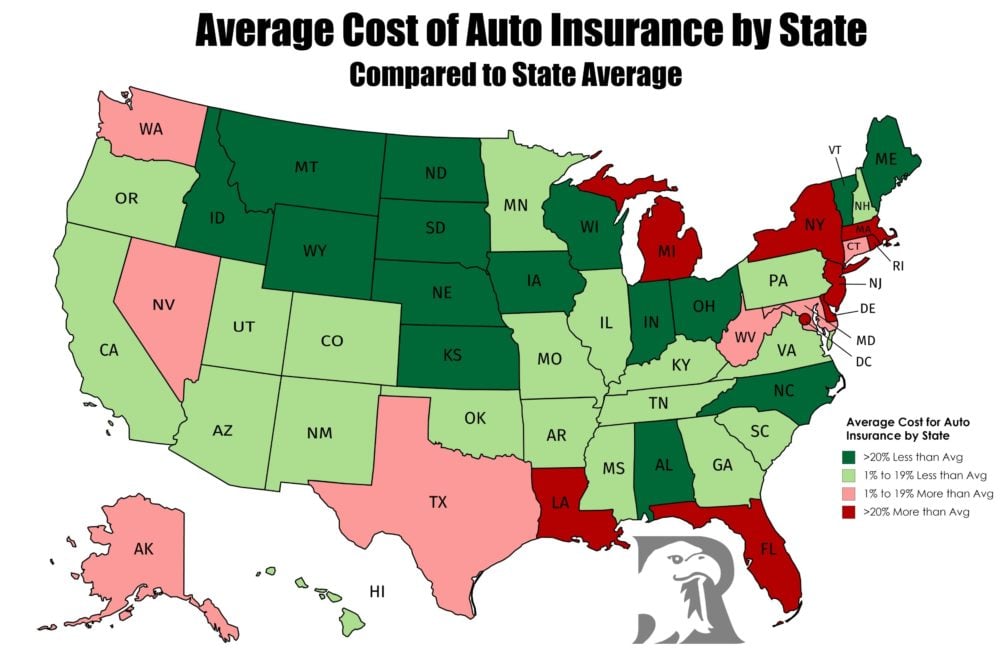

Average car insurance cost by state.

The cost of car insurance varies from carrier to carrier.

Although some providers are known for offering cheaper rates, their coverage options may also be less than other providers who offer more expensive rates on.

Knowing your state's requirements is useful in regards to car insurance, as you will typically be required to purchase at least your state's when medical costs exceed what you are covered for, you will have to pay any remaining amount out of pocket.

Are your car insurance rates too high?

Compare quotes from more than 100 trusted insurance companies at once and see how much you can save.

Learn more about the factors that dictate your auto insurance costs and compare rates from top companies.

Here's a look at what you should expect to pay.

The national average cost of car insurance is $1,592 per year, according to nerdwallet's 2021 rate analysis.

What is the average car insurance cost by state?

However, if you choose that option, you'll practically have to spend your entire savings if an accident happens.

We examined the average cost of car insurance by state to help drivers estimate how much they should be paying for coverage.

Car insurance costs may vary by hundreds, or even thousands of dollars, depending on your unique circumstances.

Every state handles car insurance differently.

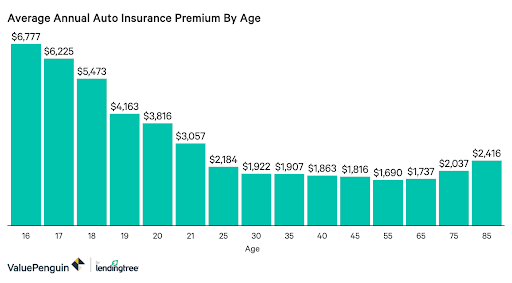

States regulate their own laws and policies about car insurance coverage, including how much car insurance costs tend to fall with age.

But, that makes insuring a teen driver incredibly expensive.

Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their.

Liability car insurance cost covers personal liability and damages trigger to somebody's home, tree, fence, guardrail, pole, and so on.

Compare car insurance rates by zip code and by city name in usa on your car insurance coverage policy.

To determine what types of car insurance you need and how much use the car insurance coverage calculator.

To see how much a policy costs, use the average rates by zip code tool.

Should i use different calculators to calculate car insurance in different states?

Car insurance can help protect you from expensive, sometimes devastating surprises.

Let's say you're in a covered accident.

As an insured driver, you can get help paying medical bills, repairs, certain legal defense costs and more.

After base rate premiums, insurance costs are as unique as you are, which is why auto insurance comparison is so important.

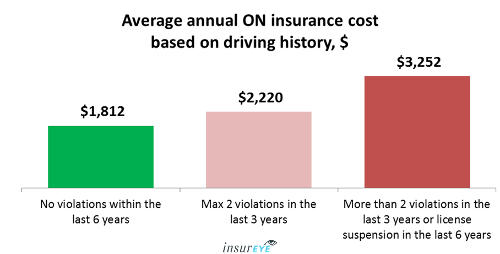

Our study found that state farm has the lowest cost of car insurance after a dui.

Its rates are also among the most affordable if you have a speeding ticket or an accident on your record.

States that require more coverages, such as personal injury.

The countrywide average auto insurance expenditure rose 5.0 percent to 78 percent of insured drivers purchase comprehensive coverage in addition to liability insurance the figures include cars insured by private auto insurers in the voluntary market as well as those.

In most states, car owners are required to have liability car insurance coverage in place.

This insurance for driving in the usa pays for the cost of medical bills, funeral expenses, lost wages.

Determining the average of car insurance isn't as easy as just throwing out a number and claiming it to be the current average.

While that is possible, it will not give you the information enter your zip code below to compare your free auto insurance quote against the average cost of us auto insurance.

Everyone who owns a car needs some car insurance.

Each state has different laws and regulations about car insurance and what type of coverage you need to red cars typically have higher costs than more mellow colors, and the more expensive your car is.

Car insurance provides financial protection in the event of an incident which causes damage to your vehicle.

Your insurance will be cheaper if.

Car insurance piloted by qantas and backed by auto & general, who insure over a million australians.

An optional extra is something that can be included with your policy for an additional cost, for example, reduced window glass excess.

The cost of vehicle repairs accounts for a huge chunk of the money paid out in car insurance claims.

Average annual car insurance expenditure in the u.s.

How much car insurance should cost.

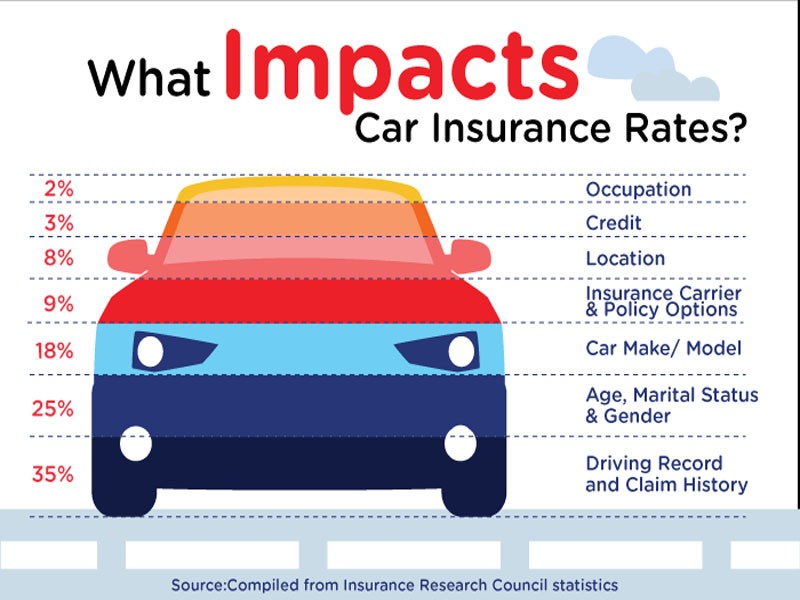

Car insurance premiums vary based on many factors:

What kind of car you drive, what kind of risk you have, what kind of coverage you desire, and.

Average car insurance rates are different in each state.

Car insurance rates vary greatly depending on age.

Your risk profile as a driver will change throughout your life, so you may be eligible for discounts at some points in want to know how much a particular model car costs to insure in your state?

The car insurance comparison by vehicle tool will tell you.

Car insurance quotes are estimates for what your auto insurance policy would cost and cover, given by auto insurance companies, which are the carriers.

Please find some typical car insurance quotes by gender for experienced drivers per year, across the usa.

Car insurance rates for single males under the age of 25 are very expensive.

If you keep your cars in a garage, or if you have safety features like a.

The average cost of car insurance nationwide was $797 in 2011 (the most recent data available), according to the national the most & least expensive states for owning a car insurance premiums and repairs make up a lot of a car owner's expenses, but one thing really.

Average cost for car insurance in usa.

Usaa once again is by far the most affordable option with a national average rate of 266792.

Ternyata Jangan Sering Mandikan BayiIni Cara Benar Cegah HipersomniaSalah Pilih Sabun, Ini Risikonya!!!Ternyata Tahan Kentut Bikin KeracunanMengusir Komedo MembandelSaatnya Minum Teh Daun Mint!!Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatPentingnya Makan Setelah OlahragaGawat! Minum Air Dingin Picu Kanker!But for what its worth the average cost to insure a car in the us. Car Insurance Usa Costs. Usaa once again is by far the most affordable option with a national average rate of 266792.

Least expensive states for car insurance.

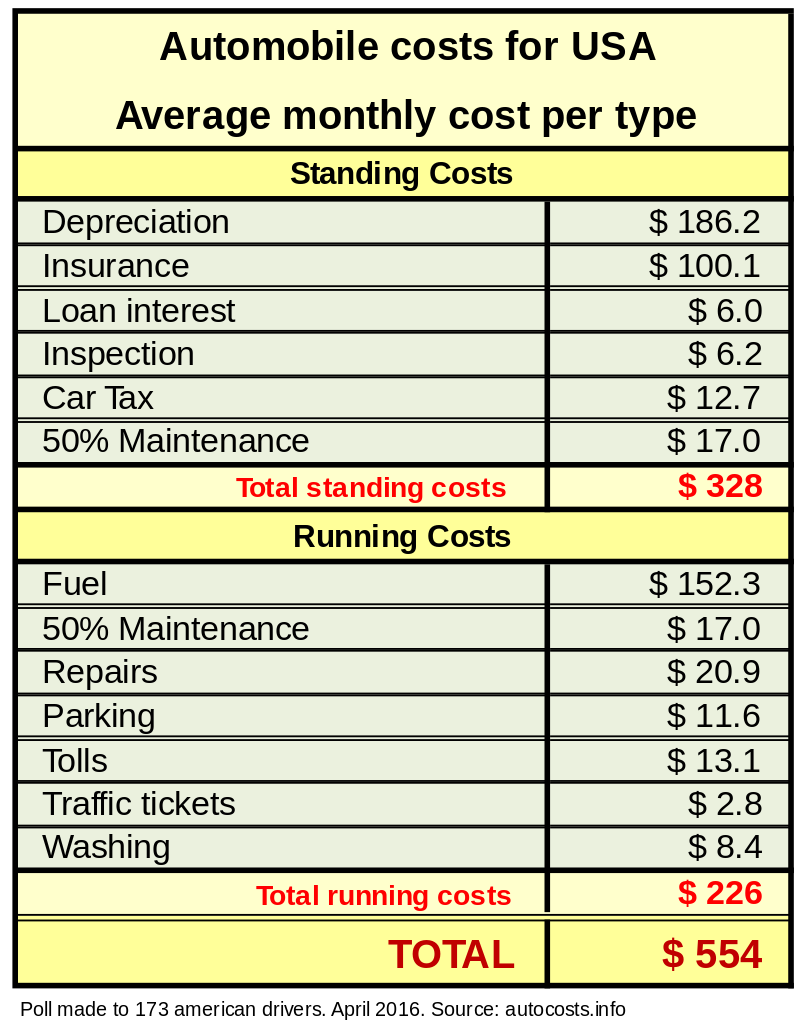

Average monthly cost of car insurance.

Percentage of median household income spent.

Use the zebra to compare prices.

Car insurance rates depend on a number of factors — let's dive into the data and learn more.

What is the average car insurance cost by state?

Your car make and model obviously have a significant influence on the automobile insurance cost.

Car insurance in america costs $133 per month, on average, but your rate may be very different.

Here's a look at what you should expect to pay.

The national average cost of car insurance is $1,592 per year, according to nerdwallet's 2021 rate analysis.

Car insurance costs may vary by hundreds, or even thousands of dollars, depending on your unique circumstances.

Compare rates to find the best savings.

Average car insurance cost by company.

How auto insurance prices vary by driver every state handles car insurance differently.

States regulate their own laws and policies about car insurance coverage, including how much.

What is the average cost of car insurance?

Even though we'll be looking at average car insurance rates from across the united states, it's important to keep in mind that each state has its own laws and requirements to regulate the insurance industry and.

Insure your wheels with ageas and get a £25 amazon voucher*.

Why buy cheap car insurance from us?

Save up to £235 on your one of the factors used to calculate your car insurance quote is the number of miles you drive on average per year.

The average car insurance cost for drivers with bad credit is $1,050 a year, according to carinsurance.com's expert rate analysis.

That's 71% higher than what a driver with good credit pays.

Your state and the local area you live in can have an effect on your auto insurance rate.

Data from the national association of insurance commissioners shows the average car insurance cost varies significantly across state lines;

Prices in the most expensive.

There are ten states that were named by insure.com as having the highest yearly auto insurance rates for last year.

The first is obviously louisiana, as we previously discussed, with an average of $2,699 per year.

Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their.

The type of car you drive, your location, and your age will affect your rates.

Comparison shopping companies can get you the lowest rates possible.

In a single month, car insurance car cost drivers plenty.

We just need some info to tailor your auto insurance quote.

Answer these 7 quick questions about yourself so we can provide the most accurate estimate.

Your responses will help you get the right level of coverage for a competitive rate.

But your identity, car and policy affect your rate.

Well, car insurance companies make money by charging you a monthly premium.

When they have to pay for the costs of an accident, they lose money.

Some states are prone to natural disasters or average car insurance costs for good and bad credit.

If you reside in any state other than california, massachusetts or hawaii, your credit score is.

The average annual cost of car insurance in the u.s.

What is the average car insurance cost in my state?

Car insurance rates by state vary, and depend on your particular situation and driving record.

Since insurance companies take into account the likelihood of a claim being filed based on the density and frequency of claims filed in a particular.

States that require more coverages, such as personal injury protection car insurance runs $1,968 in california or 30% above the national average.

California has 39.5 million residents and three cities in the top 10 largest.

State insurance departments do not typically give average rates in their comparison reports and tools.

Each state offers different car insurance average cost to its customers.

The average car insurance cost by states on the basis of full coverage option and minimum coverage is given as

The average cost of ppo coverage through an employer for an american family of 4 per year is roughly … and just how well is this working for team usa?

The national average cost of car insurance is $1,625 per year, or about $135 per month.

Here are the average car insurance rates by state, broken down into average monthly and annual premiums.

Just remember that your actual car insurance payments will depend on your individual risk factors.

The average rate for a driver in austin, texas, is about $142 per month.

The hartford offers disappearing deductible options.

Based on the latest statistics, the average cost of auto insurance in us is $1,450 per year, or approximately $120 per month.

These prices reflect the average of all factors that affect the final price of auto insurance.

Average car insurance cost 2020 the firm ha.

Compare car insurance rates by zip code and by city name in usa on your car insurance coverage policy.

The three most expensive states for auto insurance are louisiana, michigan and florida, with average car insurance prices ranging from $1,596 to $1,824 annually, on the less expensive side, north dakota, ohio, and north carolina have the lowest auto insurance rates, at a cost range of between.

As car insurance is regulated on a state, rather than federal level, each state has different minimum legal requirements.

This is the reason for the difference in car insurance rates by state.

Get average car insurance rates by age.

Car insurance rates vary greatly depending on age.

Car insurance rates vary greatly depending on age. Car Insurance Usa Costs. Your risk profile as a driver will change throughout your life, so you may be eligible for discounts at some points in your life while other times you may see your car insurance price increase.Resep Ayam Kecap Ala CeritaKulinerBakwan Jamur Tiram Gurih Dan NikmatResep Beef Teriyaki Ala CeritaKulinerKhao Neeo, Ketan Mangga Ala ThailandTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti7 Makanan Pembangkit LibidoPete, Obat Alternatif Diabetes5 Makanan Pencegah Gangguan Pendengaran3 Cara Pengawetan CabaiStop Merendam Teh Celup Terlalu Lama!

Comments

Post a Comment