Car Insurance Canada Home And Car Policies Primarily Underwritten, And Claims Handled, By Royal & Sun Alliance Insurance Company Of Canada (rsa) In Quebec And Primarily.

Car Insurance Canada. Their Level Of Protection Are Not Exactly The Same According To The Provinces.

SELAMAT MEMBACA!

Financial consumer agency of canada.

Having to pay to repair your car or other vehicle if it's damaged or in an accident.

Liability claims if you're held responsible for an accident causing damage to another person's vehicle or injury to other people.

Compare quotes from canada's leading auto insurance companies.

You've come to the right place.

Just fill out our insurance form and click the 'get started' button to find quotes from car insurance brokers across the country.

Car insurance coverage based on your vehicle.

Beyond that, there are other options to consider for your ideal coverage.

Aviva offers competitive car insurance rates with customizable coverage if you need extra protection see how much you'll save with an online quote.

Having trouble getting a good car insurance quote in canada?

There's a claims protection plan, which guarantees your.

Saskatchewan, manitoba and british columbia operate within a public car insurance model.

Car insurance in these provinces is available through the government.

Compare car insurance quotes online, for free, from canada's top providers in just minutes.

To operate a vehicle in canada, you must have a valid car insurance policy in place at all times.

In each province, car insurance policy requirements vary depending on whether it's a public or private.

So if you're planning on driving in and around the country, make sure you obtain car insurance for driving in canada, or expect to pay a large fine.

Insure your vehicle with affordable car insurance coverage in canada.

Get free car insurance quotes online to compare and save.

If you get in an accident and aren't covered, you may need to pay for.

That's why allstate offers a wide range of competitive car there's so much to consider when buying car insurance in canada, with each province requiring a different level of protection.

We're comparing the best car insurance companies and aggregator sites in canada to help make auto insurance shopping a little easier.

There are coverages you must have and then some optional ones that increase your level of protection.

Here's a summary of coverages but always review your policy so you know what's covered and what's not.

Coverage for your car or truck.

The one thing we do have in personal auto insurance is available to protect you in case of a collision, fire, vandalism, theft, or if you're responsible for damages to another person.

Get an auto or car insurance quote.

Discounts for bundling, multiple vehicles and more!

Car insurance with travelers canada provides protection for a range of vehicles, from your family truck or daily commuter, to antiques and motor homes.

Both your home and car are insured with travelers canada.

You have more than one car insured.

Save money, yes, but get what you need so you if you have a nice car, you should definitely consider spending the extra money to get some of the optional canada auto insurance coverage that.

Our guides on car insurance.

How does car insurance work in canada ?

Their level of protection are not exactly the same according to the provinces.

With car insurance, you can lessen the chances of facing financial problems as it can cover damage to your car and other circumstances in which you would be liable to pay medical here are the best car insurance companies in canada for 2020 based on car insurance review website carsurance.net

Cheap canada car insurance rates.

Comprehensive car insurance policies in canada typically take care of repairs for vehicle damage due to reasons other than collision.

Some of these reasons include bad weather, fire, theft, flooding and vandalism.

This type of car/auto insurance coverage helps you cover.

Find out where and how you can apply for car insurance in canada with minimum fuss.

Finding great value in car insurance protection is all about finding a great company that provides discounts and additional protection at the right why you need auto/ car insurance in toronto?

Toronto is the largest city in canada by population with over 2.8 million and also the economic capital.

Basic auto insurance is mandatory throughout canada.

Gather a few quotes and compare the coverage offered to find the best car insurance company for you.

Car insurance is required by law in canada because in the event of a car accident, car insurance covers the owner of the vehicle, the driver of the vehicle (with the owner's consent), passengers, pedestrians, and property!

Are you driving without insurance?

Check out classic car insurance canada.

Are you looking to save money on your auto insurance?

One major difference between canadian car insurance and u.s.

Coverage is that in some provinces in canada, like quebec, your insurance company does not pay your injury claim, the how much does it cost to insure a car in canada?

Some people ask, why is car insurance so expensive in canada?

Getting the best deal on car insurance in canada can be achieved in various ways.

Buy the coverage that you actually need.

How much car insurance coverage do you really need, and how much should it cost?

![[Canada] 10 Best & Worst Sites to Compare Car Insurance ...](https://blog.insurify.com/wp-content/uploads/2020/05/shutterstock_640627375-2-scaled.jpg)

No one ever plans to be in an accident, but according to the canadian transportation safety board there are around 160,000 car accidents in canada every year.

To get a car insurance quote in canada using our free, online tool, you'll need:

A valid driver's licence and some details of your driving history.

Yes, car insurance is mandatory in canada.

All drivers are legally required to have insurance for their vehicle, regardless of province or territory.

5 Khasiat Buah Tin, Sudah Teruji Klinis!!Segala Penyakit, Rebusan Ciplukan ObatnyaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ternyata Jangan Sering Mandikan BayiCara Baca Tanggal Kadaluarsa Produk MakananMana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Ternyata Pengguna IPhone = Pengguna Narkoba5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuAwas!! Ini Bahaya Pewarna Kimia Pada MakananResep Alami Lawan Demam AnakAll drivers are legally required to have insurance for their vehicle, regardless of province or territory. Car Insurance Canada. Mandatory coverage requirements vary by province, minimum amounts, limits, and optional coverage vary by region.

Compare quotes from canada's leading auto insurance companies.

You've come to the right place.

Just fill out our insurance form and click the 'get started' button to find quotes from car insurance brokers across the country.

Instantly compare quotes from 50+ car insurance companies.

There is a reason people trust us to find the cheapest car insurance quotes in canada:

Compare cheap car insurance quotes online.

No doubt finding the free auto insurance quotes can be a challenging job, but it can become easier and quicker with the help of an expert.

Compare car insurance quotes online, for free, from canada's top providers in just minutes.

You might think that car insurance quotes for the same driver or car would be similar across all providers.

However, every auto insurance company has its own costs to cover, based on data from their.

Is your driving record far from pristine and insurers are trying to charge you an exorbitant amount of money?

Aviva offers competitive car insurance rates with customizable coverage if you need extra protection see how much you'll save with an online quote.

After you receive your quote, an insurance broker will contact you to review the quote and determine if you are eligible for additional discounts.

All drivers are legally required to have insurance for their vehicle, regardless of province or territory.

Get car insurance quotes online and tailor coverage options with allstate.

Discover discounts and get a free personalized auto insurance quote.

In order to protect yourself, your family when it comes to canadian auto insurance prices, it really pays to compare canada car insurance quotes.

Each canadian auto insurance provider.

Car insurance statistics in canada.

There are a lot of things happening in the insurance industry.

In 2015, private insurance companies outperformed public insurance companies for the first time in 15 years.

Insure your vehicle with affordable car insurance coverage in canada.

You depend on your car to get you from point a to point b quickly and safely.

From dropping the kids off at hockey practice to.

Get a car insurance quote online today and you could save up to 30% off using the mydriving discount!

Beyond that, there are other options to consider for your ideal coverage.

Get a car insurance quote to find the best coverage at the lowest rate.

Our car insurance estimator will take less than three minutes to produce quotes from up to 10 carriers across the country.

Mandatory car insurance in canada.

Complete car looked at quotes for the minimum required insurance in each province.

Most provinces only require you to have liability insurance which covers the basics such as property damage and medical bills for others shall you.

If you get a number of different quotes (and you should), you may end up with a pretty different range of premiums to choose from.

We're comparing the best car insurance companies and aggregator sites in canada to help make auto insurance shopping a little easier.

Whether you are a canadian resident already or you are moving to canada from another country, if you own a vehicle it is important to know what kind of insurance you are going to need.

Car insurance is mandatory in canada in order to protect all the parties involved in an accident.

Unlike home insurance where an accident impacts mostly the homeowner, a car accident might impact multiple parties, and parties who are not involved can actually suffer more damage/injuries from the.

Quotes from 75+ canadian providers.

Basic auto insurance is mandatory throughout canada.

Compare ontario car insurance quotes from 30+ insurance companies & get your cheapest quote online today.

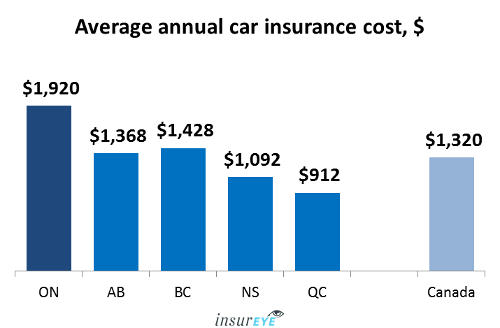

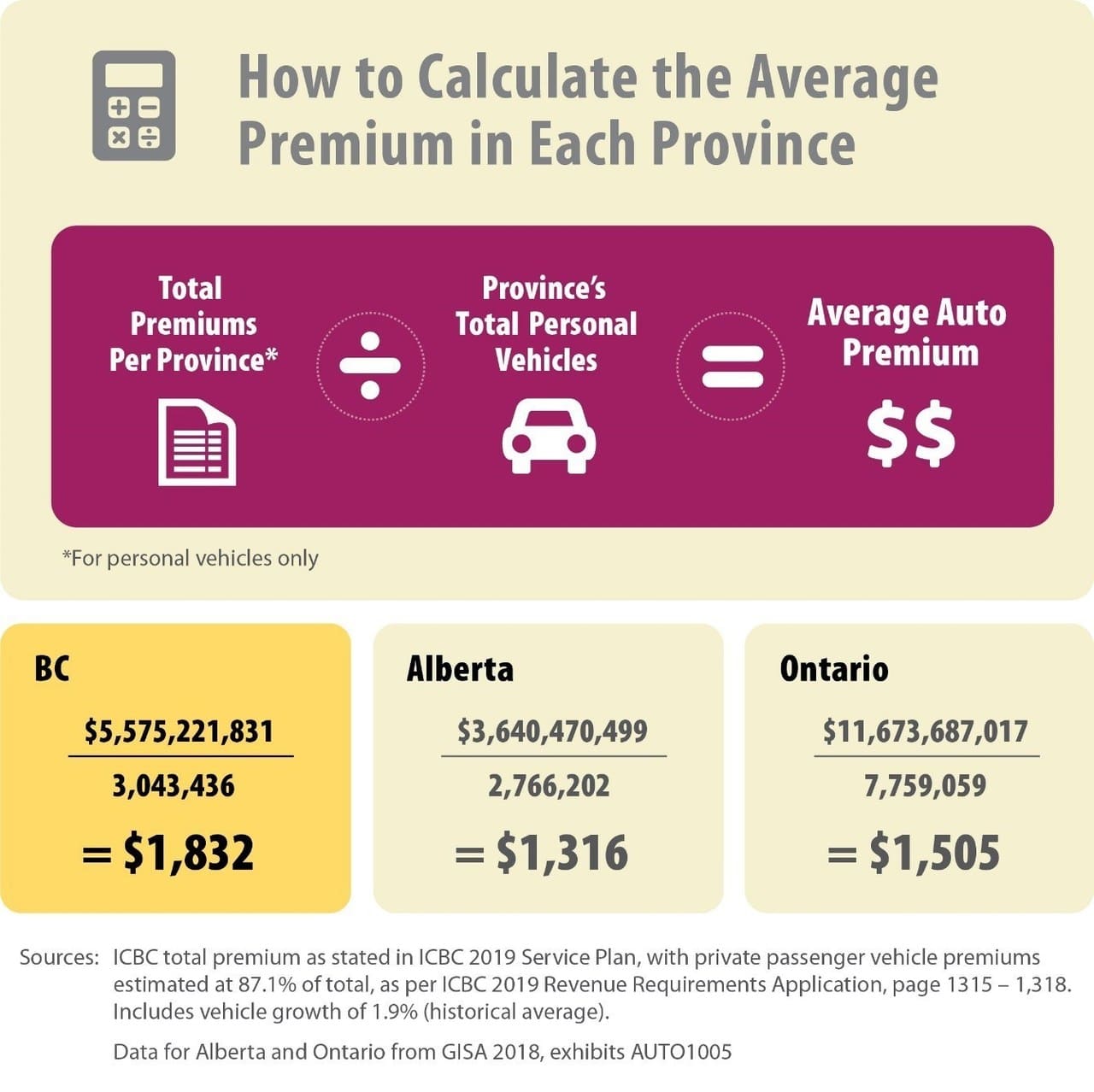

Ontario once had the most expensive car insurance premium in canada, but that title now goes to b.c, with residents paying an average of $1,832 annually.

There are both public and private run insurance programs throughout the nation, with saskatchewan, manitoba and british columbia relying on provincial run coverage, while the rest of canada is privately insured, through.

Switch to geico for an auto insurance policy from a brand you can trust, with shopping around for car insurance quotes is a great way to find the best, most affordable coverage for you.

To accurately compare auto insurance quotes.

Who a car insurance policy covers.

If you get into a car crash, your insurance may cover shop around, get quotes and compare prices from different companies and brokers to make sure you're getting the best deal.

So why are car insurance quotes in canada so different from company to company?

Auto insurance quotes for canadians are not available through an american quote comparison tool.

Coverage for your car or truck.

There's no one size fits all when it comes to insuring your vehicle.

Ready to get your personalized auto insurance quote?

Use our quick and easy online quote tool.

Compare 30+ cheap car insurance quotes.

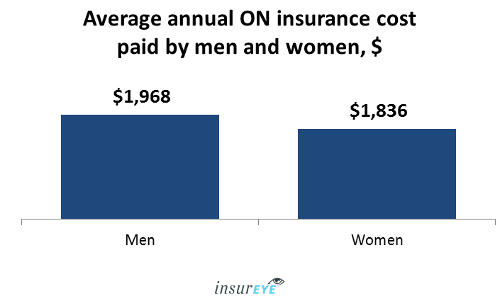

Car insurance premiums are influenced by a number of factors besides geography.

Car insurance rules vary from province to province in canada.

Typically, ontario has the highest premiums.

These factors include your location, your vehicle, your driving history, your age and.

Find canada's cheapest car insurance by comparing quotes from canada's leading insurance companies.

Find canada's cheapest car insurance by comparing quotes from canada's leading insurance companies. Car Insurance Canada. Get an online quote from one of our personal assistants.Kuliner Jangkrik Viral Di JepangResep Selai Nanas HomemadeSejarah Nasi Megono Jadi Nasi TentaraNikmat Kulit Ayam, Bikin SengsaraIkan Tongkol Bikin Gatal? Ini PenjelasannyaBakwan Jamur Tiram Gurih Dan NikmatPetis, Awalnya Adalah Upeti Untuk RajaResep Beef Teriyaki Ala CeritaKuliner5 Trik Matangkan ManggaTips Memilih Beras Berkualitas

Comments

Post a Comment